Budgeting Tips: How to Take Control of Your Finances

Budgeting is one of the most effective ways to manage your money, achieve financial goals, and reduce stress about finances. Whether you’re saving for a big purchase, paying off debt, or just trying to make ends meet, a good budget can help you stay on track. Here are some practical budgeting tips to help you take control of your finances.

1. Track Your Income and Expenses

Before creating a budget, you need to understand how much money you have coming in and where it’s going. Start by listing all your income sources, such as your salary, side hustles, or passive income. Then, track your expenses for a month to see your spending habits. You can use a notebook, spreadsheet, or budgeting apps like Mint or YNAB to make this easier.

2. Categorize Your Expenses

Once you know your spending habits, divide your expenses into categories. These typically include:

- Fixed expenses (e.g., rent, mortgage, insurance, car payments)

- Variable expenses (e.g., groceries, entertainment, gas, dining out)

- Savings and investments (e.g., emergency fund, retirement, stocks)

By organizing your expenses, you’ll get a clearer picture of where you can cut back and save money.

3. Set Realistic Spending Limits

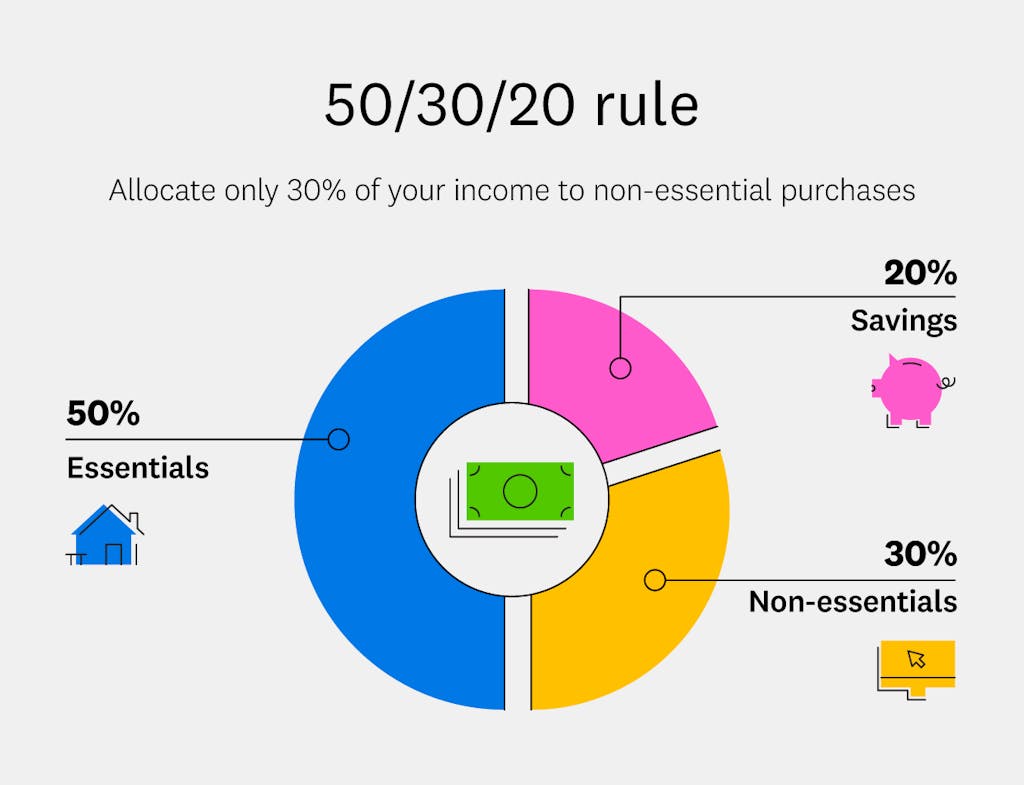

After categorizing your expenses, assign a budget limit for each category. Be realistic—don’t set amounts that are too restrictive, or you may struggle to stick to them. A good rule of thumb is the 50/30/20 rule:

- 50% for necessities (housing, food, bills)

- 30% for wants (entertainment, shopping, hobbies)

- 20% for savings and debt repayment

This method ensures you’re covering essentials while still enjoying life and securing your financial future.

4. Cut Unnecessary Expenses

Once you have a clear budget, look for areas where you can cut back. Some simple ways to save money include:

- Cooking at home instead of eating out

- Canceling unused subscriptions

- Shopping for discounts and using coupons

- Using public transport or carpooling to save on gas

Even small changes can add up and make a big difference over time.

5. Build an Emergency Fund

Life is unpredictable, and unexpected expenses can derail your budget. Set aside money for an emergency fund to cover medical bills, car repairs, or sudden job loss. Aim to save at least three to six months’ worth of expenses in a separate account to provide financial security.

6. Use Cash or a Budgeting App

To stay within your budget, consider using the cash envelope system, where you withdraw a fixed amount of cash for each spending category and stop spending when it runs out. Alternatively, use budgeting apps to track your expenses in real time and receive alerts when you’re overspending.

7. Review and Adjust Regularly

A budget isn’t set in stone; it should be reviewed and adjusted regularly to reflect changes in income, expenses, or financial goals. Set a monthly check-in to see if you’re sticking to your budget and make any necessary adjustments.

Conclusion

Budgeting doesn’t have to be complicated. By tracking your income and expenses, setting realistic limits, and cutting unnecessary costs, you can take control of your finances and work towards financial stability. Start small, stay consistent, and remember that financial freedom is a journey, not a destination. Happy budgeting!